What Is BFSI? A Complete Guide to the Sector and Its Importance

BFSI is the industry that characterizes the economies of the present and the day-to-day lives of people, but hardly anyone even has the faintest idea what BFSI stands for. You could have been wondering What Is BFSI? and now, thank goodness, this guide will walk you through its proper name, its meaning, and why it is so crucial today.

BFSI Full Form: What are the Basics

BFSI refers to Banking, Financial Services, and Insurance. BFSI is a short form for having a broad base of firms providing basic financial products and services.

- Banking involves institutions like public sector banks, private banks, regional rural banks, and cooperative banks.

- Financial Services encompass product categories such as mutual funds, investment companies, stock broking, and wealth management.

- Insurance comprises life insurance, general insurance, reinsurance, and ancillary services.

These sectors together constitute the backbone of any country's economy, offering economic stability, security, and scope for growth to individuals and businessmen.

Why is BFSI significant?

The BFSI sector is the focal point since it immediately influences almost all areas of economic activity. Some of the reasons why BFSI sector is so significant are as follows:

- Capital Creation: Banks and financial institutions provide the opportunity for people and companies to save and invest.

- Risk Management: Insurance services protect people and businesses from unforeseen occurrences.

- Employment Opportunities: BFSI offers millions of employment opportunities globally, especially in developing economies.

- Financial development: Credit, investment, and loans stimulate business growth and infrastructure development.

Simply put, the BFSI sector enables money to move freely within the economy and protects you from risks.

Sub-segments of BFSI in Detail

To know more clearly what is BFSI, let's deconstruct it step by step.

1. Banking

Banking institutions represent the most popular segment of the BFSI industry. They:

- Accepting deposits from clients.

- Loan to individuals and businesses.

- Offer web-based facilities like mobile banking, net banking, and gateways.

- Facilitate international business and foreign exchange.

2. Financial Services

These are wealth management services that assist individuals in maintaining and accumulating their wealth. They are:

- Stock market trading.

- Mutual funds and investment portfolios.

- Asset and wealth management.

- Microfinance offerings for low-income markets.

3. Insurance

Insurance firms offer financial protection in situations of uncertainty. They offer:

- Insurance to cover family members.

- Health insurance for medical expenses.

- Motor and travel insurance.

- Business and commercial organisation insurance.

Evolution of BFSI in India

India experienced unprecedented growth in the BFSI sector during the past decades. The key milestones among them are:

- Nationalisation of Banks (1969): Led to more intensive banking services.

- Economic Liberalisation (1991): Provided access to the market for foreign and private banks.

- Digital Transformation (2000s and later): UPI, internet banking, and mobile wallets transformed customer experiences.

- Insurance Reforms: Private operators and joint ventures provided consumers with options.

India's BFSI sector today is one of the world's fastest-growing sectors, and both the rural and urban markets are witnessing greater access to banking, financial, and insurance services.

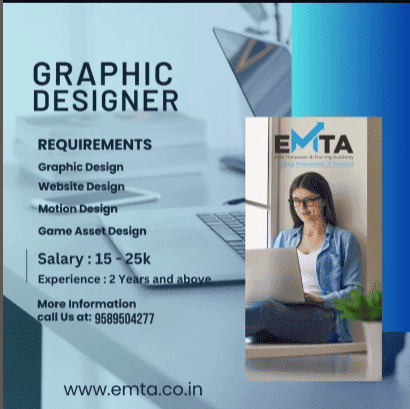

Career Opportunities in BFSI

If career opportunities are on your mind, then the BFSI sector has much to offer. Some of the most job-sought designations are:

- Banking Officers and Managers: Overseeing loan activities and customer accounts.

- Financial Analysts: Evaluating investment opportunities.

- Insurance Advisors: Counseling customers on available coverage.

- Risk Managers: They identify and manage financial risks.

- Customer Relationship Managers: Building confidence and customer satisfaction.

As BFSI continues to expand, professionals in the BFSI sector are also in demand.

Skills Needed to Work in BFSI

Technical and people skills would be necessary to succeed in BFSI. The key skills are:

- Numeracy and financial literacy skills.

- Customer service and communication skills.

- Critical thinking and problem-solving.

- Adaptability in embracing new tools such as digital banking.

- Awareness of compliance and ethical decision-making.

BFSI Challenges Facing the Industry

Just like any other industry, BFSI too has its issues:

- Cybersecurity Threats: With increasingly more transactions becoming online, information must be guarded against threats.

- Regulatory Compliance: Banks must adhere to extremely stringent rules and regulations.

- Market Volatility: Investments and markets are dominated by events globally.

- Customer Trust: One must maintain one's integrity and ethics.

Bridging these challenges calls for persistent innovation, improved regulation, and skilled professionals.

The Future of BFSI

In the coming couple of days, the BFSI industry will witness further changes:

- Artificial Intelligence and Automation will speed up processes and make them more efficient.

- Digital Banking will expand even more in rural and semi-urban regions.

- Individualized Insurance Products will meet diversified needs.

- Sustainable Finance will increasingly play a prominent role as companies adopt green strategies.

These reforms will not only enhance the customer experiences but also enhance the economic base of the economy.

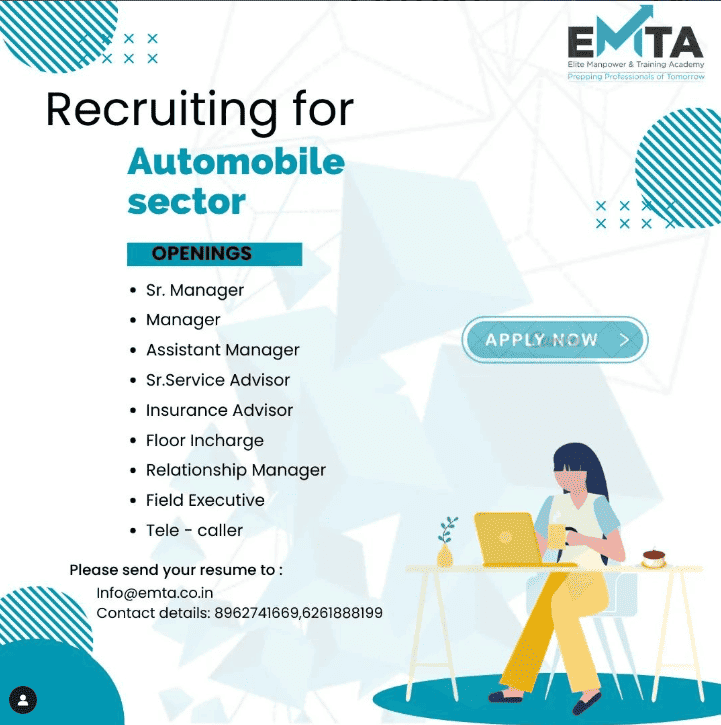

BFSI and Indian Employment Placement

Since BFSI is a largest employment-generating sector, the candidates like to take professional guidance for placement. For instance, the majority of them avail the services of Placement Consultants in Indore and other cities to get placed in a banking, financial services, or insurance company. These placement consultants serve as go-betweens between the companies and the candidates and facilitate talented professionals to enter the industry hassle-free.

Final Thoughts

So, What is BFSI? It is an umbrella term for Banking, Financial Services, and Insurance—sectors that propel economic development, ensure security, and generate millions of career opportunities. With the globe going more digital and connected, the BFSI sector can only expand, offering more services, better customer experiences, and greater economic support. For businesses, professionals, and students, it's not a choice anymore—it's a must to learn about BFSI.

At EMTA, we feel that education on subjects such as BFSI enables individuals and organizations to make informed decisions for a better future.